Well, some might call it prices increases or market is overheating, but the truth is that the whole messy situation is now a huge bubble, fueled by extremely cheap money and other conditions that are presented below.

First, the news as they appear in the press:

NL home prices up 18%; Biggest increase in 21 years

The overheating in the housing market will not come to an end yet. In August, owner-occupied homes became 17.8 percent more expensive than a year earlier, with which house prices rose even faster than in July. According to Statistics Netherlands (CBS), this is the largest price increase since September 2000

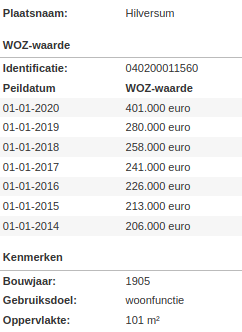

So 18% YoY and the biggest increase in 21 years. Of course, conditions are slightly different along different regions in the Netherlands, but if you can check this site for a random address, you will notice numbers as follows (for the last 7 years):

Most of the houses around doubled their WOZ value in the last 7 years, with a strong acceleration in the last 2-3 years. To be noted that this value is used for taxation purposes, but it doesn't reflect the selling price of a house on the market (that might be +10/15k euro more at least).

However, there are a couple of factors that lead to this whole bubbly situation:

- first of all, a housing shortage, that NL is battling for a long time. Holland is a small country with quite big population, so no big news here; this is part of the offer-demand equation in the end.

- cheap money! This money is just created out of thin air by the European Central Bank and pushed through the whole banking system. This leads to a situation where the bank are giving away large chunks of money (as hypotheek - mortgage) for 30 years with interest rates around 1-2% (or less!). Eventually, renting a place becomes more expensive than buying a house and paying the mortgage rate! (subprime?). Here you have an example of a calculator - less than 1% interest rate for a 10 years term.

- easiness to qualify for a mortgage. The risk of loaning money is pushed to the minimum and the banks know they will get saved either by the government or/and by their own creditors (people with bank accounts) if the things are getting hairy. Too big to fail kind of situation. It's not uncommon for the expats with a couple of months of working here in the NL (and even a temporary contract for 1 yr) to qualify for a mortgage.

- no down-payment to buy a house. For many years, the mortgage will even cover >100% from the house value. That meant that even the notary, transfer tax (and any other extra costs) will be paid by borrowed money. From 2018 is not possible to get over 100% of the house valuation, so eventually you have to have some money (a couple of thousands euro) for the buying process. Even so, some amounts are tax deductible, so you get some money back next year when you fill in the tax declarations.

- negative interest rates! These are passed by the banks to their customers eventually (since ECB is launched in this fucked up experiment of negativity). This year the accounts under 100.000 euro are safe, but probably not that much in the next couple of years. And since some people are having some more money in the bank that are hit by inflation, taxation and now even negative interest rates, they are just buying properties as assets that are constantly appreciating.

Some of the reasons are also pointed out in the mentioned article, but unfortunately not enough voices are raising this concerns, since that will mean to trouble more ECByish waters than it's allowed:

Mortgage interest rates are also historically low and home buyers can borrow more from the bank. Low interest rates also make a house more interesting as an investment because bonds yield little.

So it's interesting to see how much longer this situation will keep on going, since no matter how easy the access to the money is, still some limits apply (borrowing upper limit, properties so expensive that most of the people cannot afford anymore no matter what, and so forth). A lot of families are also leveraged to the maximum, so any change in their income will have drastic consequences.

The bubble keeps going on for now. It only looks for the right pin to go bust.