The game of QE or printing money out of thin air and buying government bonds on the market. As zerohedge let us know:

Christine Lagarde's bank finally delivered on its promise to boost the pace of emergency bond-buying to offset the economic threat of tighter financial conditions from higher yields.

The ECB revealed today that net purchases settled last week (through March 17) jumped by €21.1 billion, up from €14 billion the week prior and the most since the start of December (the figure is reduced by redemptions, with the the gross value of purchases set to disclosed on Tuesday)

Of course, they blame the deterioration of the economic environment on COVID and such, but that's the whole BS these days.

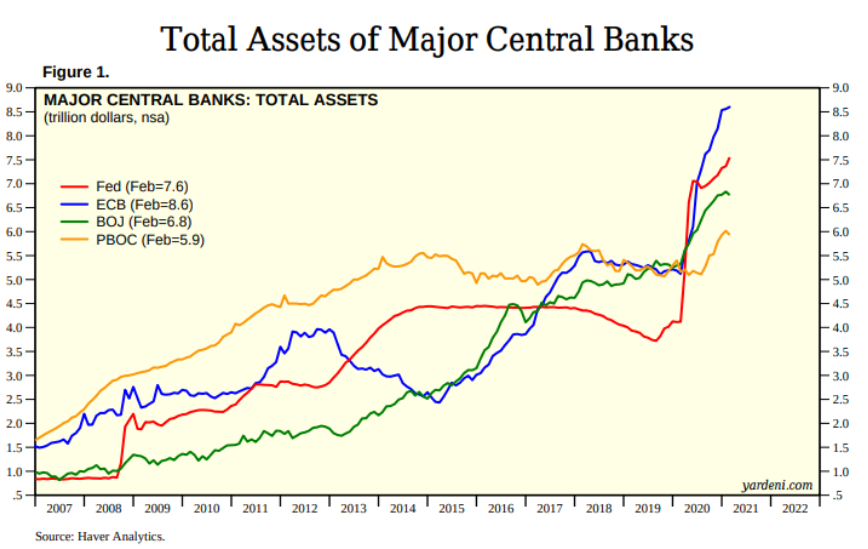

The truth is that, without ECB buying government debt, some states (like Italy or Greece for example) will go bankrupt, since no one else will or if they do, they will do it at a higher price. ECB is completely altering the price formation on the market, removing basically the risk of lending money to (otherwise) high-risk borrowers. But, as in US (FED) once this game is started, it never can stop. The debt pile (which is mostly junk bonds) is continuously increasing all over the world: