It's been over two years of anti-Covid battles that left big scars for the world economies everywhere, with the whole sectors being brutally affected by the lockdowns and other imposed measures. And this period was a perfect occasion for the central banks (as FED in the US or ECB in Europe) to print even more outrageous amounts of money, all in the name of the greater good. And all these inflated balance sheets balloons, eventually, are finding their pin.

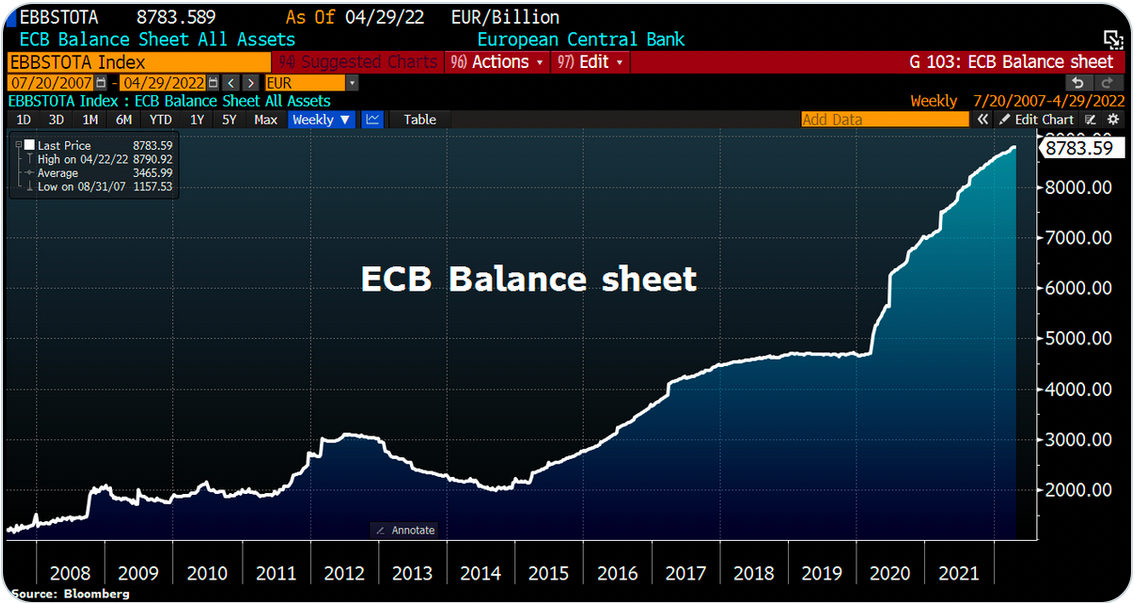

In the month of April 2022, ECB balance sheet looked like this:

Source: Holger Zschaepitz

And indeed, for the first time since Oct 2021 this balance sheet shrank by €7.3bn. But keep in mind that Lagarde is still keeping her foot on the QE speed pedal and doesn't even bother to think to raise the interest rates soon (currently in the negative teritory).

ECB balance sheet equals now 82% from the Eurozone GDP (€8.7 trillions).

Add on top of this the stubbornness of the ruling class in the European Union to get rid of the Russian oil and natural gas by all means*, and you have the perfect storm brewing. And that will mostly likely to hit by the end of the year, in autumn and winter. Food prices are already soaring, with most of the products getting easily increases of more that 10-20%.

And what are the officials thinking about this? Well, it's convenient to blame it on the war:

"There is no doubt that the EU economy is going through a difficult period due to Russia's war against Ukraine, and we have revised our forecast downwards accordingly," said European Commission Vice-President Valdis Dombrovskis

And the predictions are always looking good, especially for the next year.

Inflation in the euro area is projected at 6.1% in 2022. This represents a considerable upward revision compared to the last #ECForecast(3.5%).

Inflation is expected to peak at 6.9% in 2nd quarter of 2022 & decline thereafter until falling to 2.7% in 2023Source: europa.eu/!CgtVFv

With an (official - kept at minimum) inflation of around 10% here in the Netherlands, last seen in May 1976, all this 6% seems like a wishful thinking and as usual, extremely bad estimation from the official voices. We have the great example of FED, that was trying hard to reach the 2% threshold, considered healthy for the economy for some reason, and then ignoring the rise, and then saying it's temporary and now admitting they did some mistakes in the estimation but it's not that bad (like 4x more that their initial threshold).

The price of oil and natural gas will continue to rise, since the Russian source gets cut and no viable replacements are actually there. The food price will continue to increase. More and more freshly printed trillions will be thrown into the game, to (ironically) fight inflation. Which will create even more inflation.

Put into the mix the fact that zero Covid policy in China is creating already huge problems to the supply chain, and with no doubt, the shit will hit the fan this year.

But it will be much worse than advertised.

* with the exception of four states at this point, Hungary, Czech Republic, Slovakia and Bulgaria, who refuse to be dragged in this economical suicide