A recent article from euronews.com is bringing into light, the (obvious for most of us) fact, that inflation is here, biting hard and it's not going to be "transitory" like our overlords from FED/ECB are trying to convince us.

But let's dive a little bit into the content of this article:

As Europe's economy recovers, things are getting expensive – really expensive.

The first paragraph and they nailed it. Kudos!

In October, inflation for energy reached a stunning 23.5% (up from 17.6% in September). The European Commission expects energy costs to remain high until March or April when temperatures increase and electricity consumption from heating decreases.

In the NL the energy prices basically doubled. So the 23% I assume this is some sort of average, since the rises are not the same amongst EU members and the implications are not visible at once. But without a doubt, we're getting to a higher number soon. But expecting energy costs to come down due to lower consumption is plain wrong. The prices are not increasing due to higher consumption. Read on...

The last time the eurozone broke through the 4% barrier was in the immediate aftermath of the Great Recession, in July of 2008 (also 4.1%).

Keep in mind these numbers are specially manufactured to look low. Only check the jump in housing prices and you'll get why it's just bullshit. Even so, considering their price calculating methodology, they are increasing.

The best part is yet to come:

The latest inflation reading adds pressure on the European Central Bank and its president Christine Lagarde. The ECB is meant to maintain price stability and make sure that inflation remains low, stable and predictable.

Obviously they missed the price stability target by far. Inflation, even measured with their tools is not matching the arbitrary, idiotic chosen 2% threshold. But do they give a shite? Nope.

"We continue to foresee inflation in the medium term remaining below our 2% targets."

This would be laughable if the reality would not kick back at us in an ugly way. We have no idea why they mean by medium term, but even the mighty FED changed their rhetoric from transitory to not-so-transitory in a matter of months.

When inflation grows, interest rates are expected to follow suit. Those who lend money demand higher rates to ensure they don't lose money when borrowers pay them back in the future.

That's true, even if the market is highly manipulated by the central banks. But what's ECB planning to do? Exactly. Nothing.

For the time being, Lagarde refuses to change course and will keep negative interest rates in place to help consumers and businesses borrow money more cheaply and, in turn, maintain the momentum of the economic recovery.

Economic recovery has nothing to do with this. First of all, negative interest rates are quite a dangerous experiment; they distort the money market, the banking system and eventually the account holders will take the hit. It also pushes financial structures to get rid of the money in all kind of risky instruments. Or pushing even more the gigantic asset bubble (that here in the NL is easily recognizable by overpriced homes).

But the main reason for ECB refusing to raise interest rates, is that they are caught in their own web of lies. Raise the rates, and the interest rate for government borrowing also rises. This will make (bankrupt) states as Italy or Spain or Greece to lend money at a higher cost. The only reason they can still sustain their spending is ECB: keeping artificially low rates (breaking the free market price mechanism) and buying a lot of debt. Monetizing the debt. The direct consequence of this is inflation.

So, to conclude, inflation is not the effect of supply chain issue, or economic recovery, or this sort of crap. The inflation is a direct consequence of the insane printing money machine kept in place by the central banks (ECB in our case) for so many years.

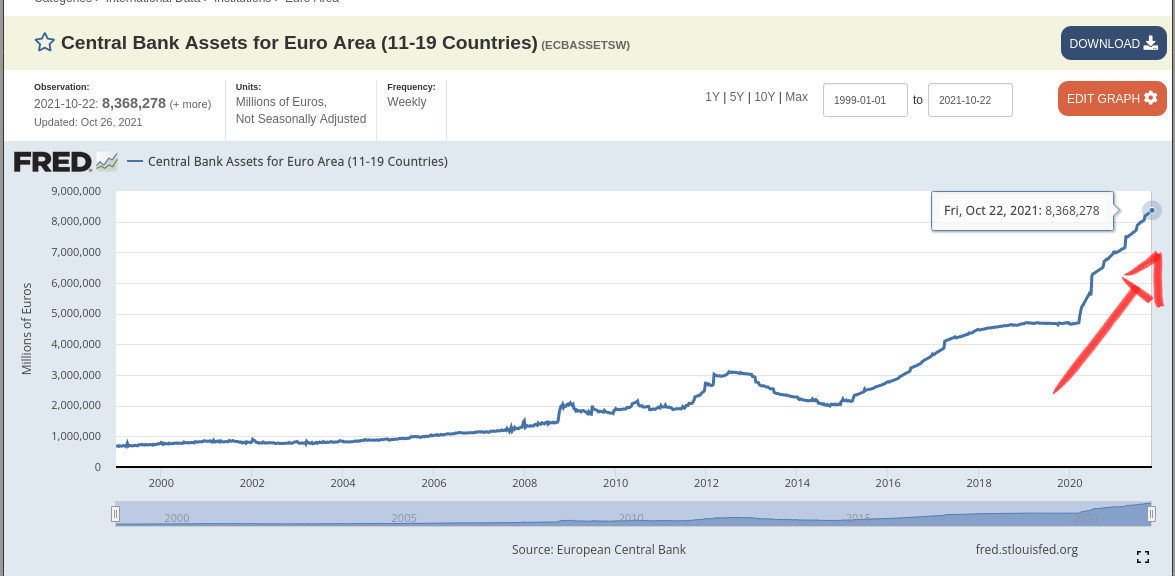

To easily visualize what's going on, check this graph out:

European Central Bank, Central Bank Assets for Euro Area (11-19 Countries) [ECBASSETSW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ECBASSETSW, October 28, 2021.