In a quite turn of events, after so much thought and discussions, European Central Bank (ECB) decided that it's time to act decisively against inflation, and show everyone that it's a responsible central bank, led by even more responsible people.

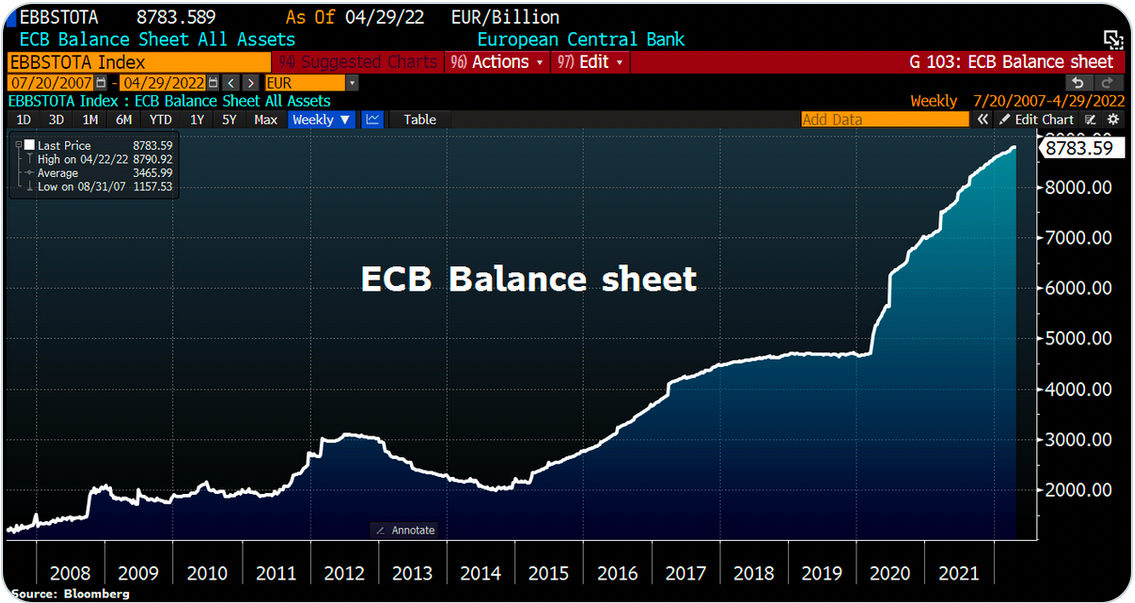

And what a decision that was! Starting with the next month, yeah, not now but the next month, they will raise the interest rate from -0.50% to -0.25%. That's right, it's still MINUS quarter of a point, but it's the first move in 11 years on continuous printing and printing. That almost 9 trillions € balance sheet doesn't grow itself, does it?

But now, since the inflation is extremely real and brutal for all the EU countries, ECB needs at least to pretend that they have it under control and they will do "whatever it takes" to keep it under control. Unfortunately for them, running with official inflation over 8%, but in most cases (like the Netherlands) with more than 10 (official) percent - things aren't going to be pretty. And since the stupid narrative of having a threshold of 2% target for the inflation doesn't apply anymore, we're 4 times over and not in Kansas anymore.

But fear not: they recognized inflation as a "major challenge for all of us". Of course, for some more and for some less.

"High inflation is a major challenge for all of us," Lagarde said after a meeting of the Governing Council in the Netherlands.

Lagarde doesn't waste any time to blame Russia for the European problems. Putin seems to be the true source of inflation, not the pin that actually is looking for the big inflated bubble. But optimism is at its best:

"But the conditions are in place for the economy to continue to grow and to recover further over the medium term."

The ECB expects inflation to remain "undesirably" high for the next couple of years: 6.8% in 2022, 3.5% in 2023 and 2.1% in 2024.

A central bank, that's hardly able to pinpoint a correct number for the inflation, that it's targeting 2% and it delivers 4 or 5 times more, that bank is expecting 3.5% next year! 3.5%!!! When this autumn and winter will be a big blow to the EU as a whole, since some clever politicians thought that cutting Russia out of the energy list of suppliers is a simple decision, with limited consequences. They got it all wrong, and we can see already the results. But we'll talk more after the winter about this, that's a feeling.

They intend to finish as well the famous asset purchase programme, that is actually financing deficits in different states, as Italy, Spain or Germany. But the finish is not quite the finish, since on a free market, the borrowing costs will go up like crazy for different states.

Also as expected, ECB decided to end net asset purchases as of July 1, 2022. It will “continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.”

Source: actionforex.com

So yeah, nothing to worry about: things are changing but we're not changing anything actually.

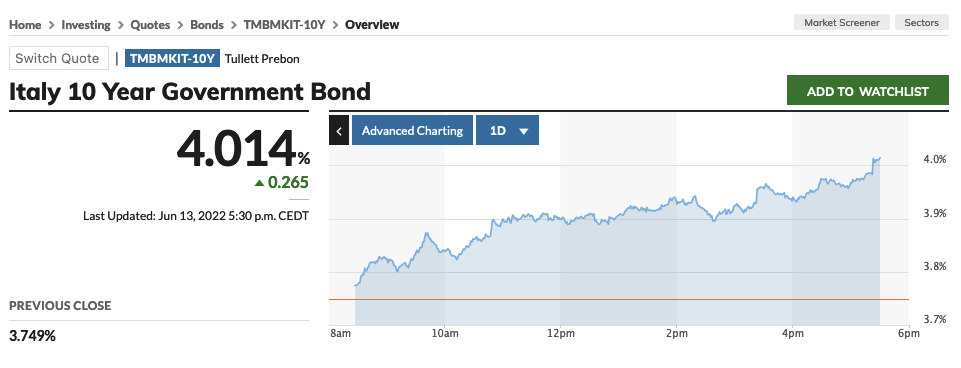

And what about 10 years Italy bonds, with this reassuring ECB attitude? Well, today for example, it hit a nice round number of 4%, unseen for a long time (since 2014 to be exact).

Of course, even Germany is affected and now their 10yr is at 1.62% from one year ago, being negative (-0.11%).

So, ECB will simulate that the situation is under control at any costs; it's about face, it's not about concrete measures. Unfortunately, like Covid, this will not pass by itself. Something needs to give in the process.

If the government borrowing costs will continue to go up, the ECB will be forced to come back to bond buying and implicitly, to generate more inflation in the the market. That will lead to even more social discontent and economic pain, but at least, the euro will be saved from a tragic end in short and medium term.

But not euro's value.

Thanks to the EU high level politicians (like Ursula von der Leyen) and its inept central bank.