Even if first of April is considered Fool's day, the news about the inflation rate was as serious as it gets. The Netherlands measures now a 12% inflation rate YoY. And indeed, an historical number, since the last time the inflation was so high was during the oil crisis in 1975!

Jumping from 7,3% in February 2022, inflation seems to accelerate everywhere, and more and more industries and services are getting caught by it. Electricity doubled and gas went even higher this year. And this after other increases from the previous years. And since basically everything in the economy is based on energy, it is a matter of time until the snowball gets rolling down the cliff, getting bigger and bigger. Taxes are higher this year as well, with roughly 10%. Petrol (as Euro 95) around 2.50 euro/liter. Food... higher and higher.

And the housing market... well, astronomical levels. Only in February this year the rise was 20%! Indeed, less and less houses are actually changing hands, since the middle price is way over €400.000. More and more people are talking now about a market bubble, and they're willing now to wait for this bubble to pop.

House prices have been rising steadily since June 2013 when they hit a low during the financial crisis. Compared with that month, prices have risen by nearly 92%.

As everywhere, the most affected are the ones on low income (or minimal wage, if you prefer). The rising transportation costs are hitting directly everyone moving to and from a job:

About 30 percent of shop employees can't make ends meet, according to trade union FNV. And one in five working Netherlands residents worry about the rising fuel and energy prices leaving them with financial problems

Obviously, the war is Ukraine accelerated the whole process, but the inflation seeds were sown long time ago by all the major central banks: Federal Reserve, European Central Bank, Bank of Japan, Bank of England and so forth. Reckless years of money printing are finally yielding some results. Elon Musk or Bezos got richer, but the rest of the people got screwed.

Remember, not so long ago FED was hitting a 2% inflation rate, seen as a nice threshold (by themselves). Well, the mirrored image of FED in Europe is ECB, a corrupt hedge fund, which basically was getting the same memo, just slightly delayed:

In July 2021, the Governing Council of the ECB announced its new monetary policy strategy. Having previously pursued to keeping inflation “below, but close to, 2%” over the medium term, it now considers price stability to be best maintained by aiming for a 2% inflation target over the medium term.

Inflation started to raise one year ago, and first the FED, and then ECB, were labelled it as transitory. Clueless as ever, the European Central Bank repeated the same poem, with no regards to the reality. In December 2021, they were still sticking to the transitory narrative:

Euro zone inflation remains temporary, two key European Central Bank policymakers argued on Thursday, even as U.S. officials made the case this week for abandoning the use of "transitory " to describe what have proven to be persistent price pressures.

"The current inflation spike is temporary and driven largely by supply factors," ECB board member Fabio Panetta told a conference.

At that moment in time, inflation was already raging at 5%, being anything but transitory. Currently it's 12%, so in this case, ECB fucked us up 6 times over. Nice job.

Obviously, they blamed the Covid, and now the Ukrainian war for these troubles, but those are only distractions. When everything stayed at home, helicopter money was created and given away. The monetary mass increased and the volume of goods and services decreased. And in a full inter-connected worlds, the waves are propagating in all directions, affecting everyone, but at different moments.

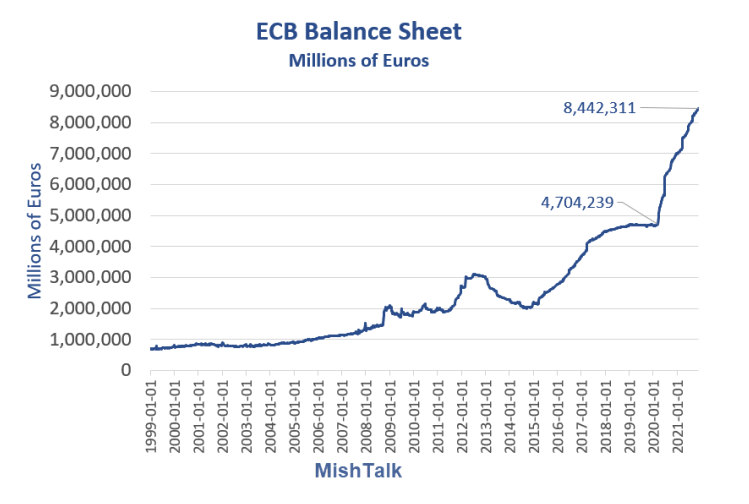

Now, let's take a look at the ECB balance sheet. It's really beautiful, and it's pointing right at the sky:

As of November 19, the ECB's balance sheet reached €8.44 trillion ($9.52 trillion). Pre-pandemic levels were at €4.70 Trillion, but still, even 4x times bigger than in early 2008!

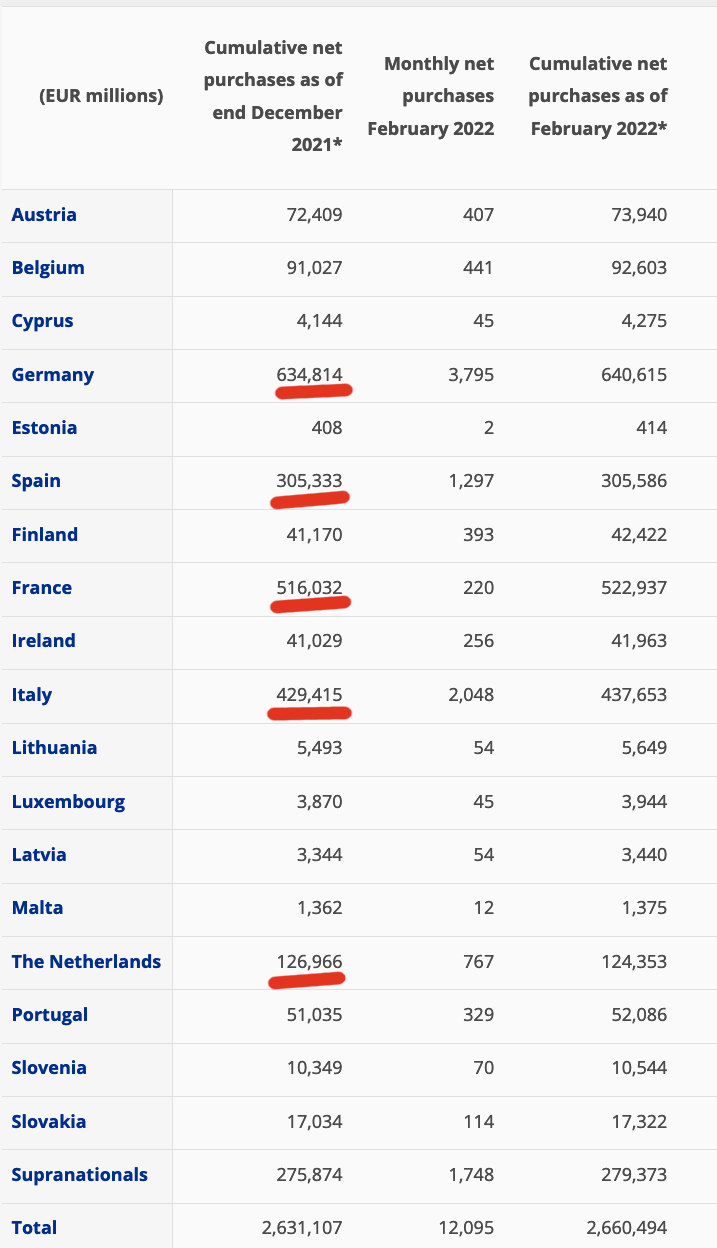

And under their famous Public Sector Purchase Programme (PSPP) - besides other various programmes - they bought tons and tons of public debt, from different eurozone countries.

We can notice there a couple of the known problematic economies as Italy, Spain or France. But surprisingly, Germany is leading the pack, absorbing the most of the printing press: over €640.000.000.000 by the end of February this year! The total is 2.6 trillions, only under this schema alone.

So now, if you're living in the Eurozone and you're wondering where this inflation is actually coming from, take a moment and make sure you properly thank European Central Bank and its creation, the euro.